home equity loan foreclosure texas

Has promulgated rules for an expedited foreclosure proceeding specific to equity loans. Texas Home Equity LoanHELOC Closing Instructions Addendum.

There are significant limitations on this type of loan the most important being that a home equity loan plus other secured indebtedness balance due on a mortgage andor home improvement loan cannot exceed 80 of the equity in the home.

. If you miss payments on your loan the lender can foreclose on your home. If a borrower defaults on either the mortgage or home equity loan the lender will initiate foreclosure proceedings. Represents Clients in Home Equity Loan Foreclosure lawsuits in all counties in Texas.

Home Equity Loan Consumer Disclosure English version to be used until Dec. Find Useful And Attractive Results. Rules 735 and 736 of the Texas Rules of Civil Procedure govern the process by which a lender may file a verified application in the local district court seeking foreclosure of a home equity loan.

Youll need more than 20 percent equity in your home to benefit from a cash-out refinance loan in Texas. Home equity loan at a time although a homeowner may have liens from other sources such as a home improvement loan or a tax lien. It was not until 1997 that Texas voted through a ballot initiative to.

Home Equity Loan Texas - If you are looking for lower expenses then our services can help you improve financial situation. Home equity loan texas calculator. Send Notice of Default along with Right to Cure and Notice of Intent to Accelerate.

A home equity loan foreclosure in Texas involves an additional step. They must obtain a judgment from the court before they are allowed to sell the property. Some of the changes made by the 2003 constitutional amendments allow homeowners who currently have one type of home equity loan to refinance it with another type of home equity loan to comply with the limitation in.

The provisions applicable to home. How Home Equity Loans Work in Texas. This procedure is rare in Texas.

A home equity loan foreclosure in Texas involves an additional step. Examine loan documents to determine if loan qualifies as a home equity loan under Section 50a6 of the Texas Constitution. A lender whose discussions with the borrower are conducted primarily in Spanish for a closed-end home equity loan may rely on this translation of the consumer notice developed under the.

The lender normally makes a bid on the property using whats called a. After the time period to cure expires but at least 21 days before the sale date the servicer must mail a second notice notifying the borrower of the foreclosure sale. Texas Home Equity Election Not to Rescind.

Thats because youll have to leave at. The sale is a public sale open to all bidders. See Rule 309 of the Texas Rules of Civil Procedure for the court rule governing judicial foreclosures.

One point typically costs1 of. A home equity loan is a special form of a home mortgage that allows a homeowner to borrow against home equity the difference between the homes fair market value and the total balance of all debts secured by the home. If your home value drops you could end up with high LTV or even underwater on your 27.

Homeowners can refinance a Texas cash-out loan into a conventional loan after one year however it might not make sense to do so depending on the current. For example if your home is worth 200000 and you owe 120000 on your home mortgage. TEXAS HOME EQUITY FORECLOSURE PROCESS In Texas any Deed of Trust that grants the trustee the power of sale can also be foreclosed judicially While Texas Home Equity foreclosures are governed instead by Rule 736 of the Texas Rules of.

A judicial foreclosure requires the lienholder to file a civil lawsuit against the homeowner. The bank must ask a court for permission to foreclose. The APR is available to borrowers requesting a loan amount from 300000 to 548250 with a credit score of at least 740 and an LTV maximum of 80 on a 35-day lock.

Constitutional Requirements for a Texas Home Equity Loan 1 The home equity loan is voluntary applicant is not required to obtain a Home Equity loan and the Home Equity lien is created under a written agreement with the consent of each owner and each owners spouse 2 The total debt encumbrances on the homestead including. Home equity loans are strictly regulated by article XIV section 50a6 of the Texas Constitution which promulgates a large and often confusing number of rules and regulations regarding loan origination that frequently leads to subsequent consumer litigation. Defending Against Home Equity Loan Foreclosure In Texas.

What to Know About Home Equity Loans Greater New. A Texas cash-out refinance loan also known as a Section 50a6 loan is another type of home equity loan that allows homeowners to refinance their current mortgages while using their home equity. The general foreclosure rules are set forth as Rule 735 of the Texas Rules of Civil Procedure.

Although the Texas reverse mortgage may be thought of as a particular type of home equity loan it is important to note that the numerous conditions imposed on home equity loans under Section 50a6 are inapplicable to reverse mortgages authorized by Section 50a7. The lender has to ask a court for permission to foreclose. Texass reluctance to embrace home equity loans is well-known.

Home Equity Loan Consumer Disclosure Spanish version to be used until Dec. The proceeding is limited in scope. In 1997 Texas for the first time allowed homeowners to use the equity in their home as collateral for unrestricted cash borrowing.

Home Equity And Heloc Loans Complete Guide

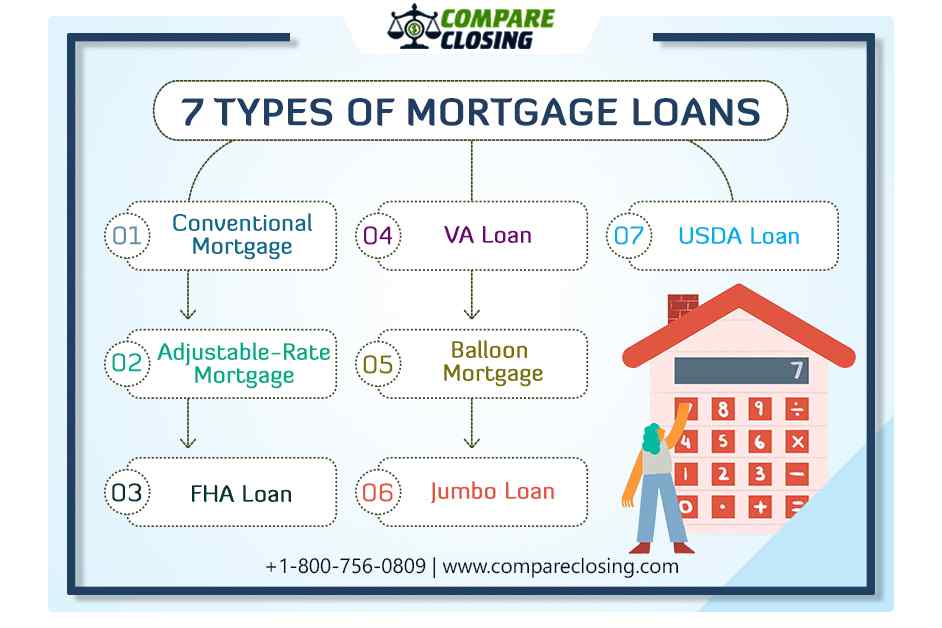

7 Best Types Of Mortgage Loans In Texas For Homebuyers

How To Get A Home Equity Loan With Bad Credit The Lenders Network

/dotdash_Final_Buying_a_Foreclosed_Home_Sep_2020-01-b380bb81fa8447ad91680267cd59377d.jpg)

Buying A Foreclosed Home How To Do It And Risks

How Does A Home Equity Loan Work In Texas

Fha Loans In Texas First Time Home Buyers

Can You Use Home Equity To Invest Lendingtree

How Home Equity Borrowing In Texas Has Forever Changed

Your Guide To Home Equity Loans In Texas

The Truth About Reverse Mortgage Foreclosure Rmf

You Have Numerous Financing Options For Buying Texas Foreclosed Homes Realtynowcom

Texas Home Equity Affidavit And Agreement Fill And Sign Printable Template Online Us Legal Forms

/dotdash_Final_Buying_a_Foreclosed_Home_Sep_2020-01-b380bb81fa8447ad91680267cd59377d.jpg)

Buying A Foreclosed Home How To Do It And Risks

Houston Foreclosure Attorney Westbrook Law Firm Pllc

How Does A Home Equity Loan Work In Texas

How Home Equity Borrowing In Texas Has Forever Changed

/dotdash_Final_Buying_a_Foreclosed_Home_Sep_2020-01-b380bb81fa8447ad91680267cd59377d.jpg)

Buying A Foreclosed Home How To Do It And Risks